September 23, 2021 | Estate Planning

Your Cheat Sheet to Understanding Trusts in Retirement

How They Work, What They Do (or Don’t Do) and How They’re Used

Regardless of life stage or approach, estate planning is an emotional process. That’s because the heart of the matter is often the care and well-being of someone you love, and for that, you want to be sure you’re employing the best tools possible. Enter trusts.

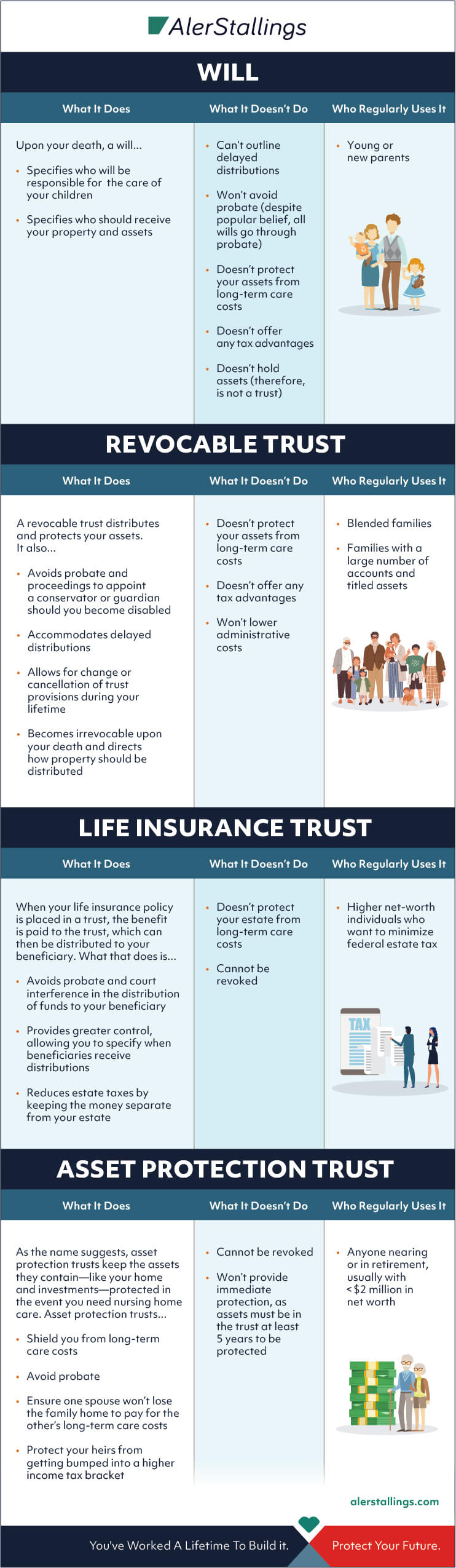

Trusts are legal vehicles that hold assets on behalf of a beneficiary or beneficiaries and they’re a valuable tool in estate planning and elder care law. There are many types of trusts, which can make navigating the options confusing. That’s why we created this handy cheat sheet to provide an easy point of reference for some of the most common terms you’ll hear.

At AlerStallings, we leverage all of these—especially asset protection trusts—and many more. Asset protection trusts are particularly beneficial because they provide protection against long-term care costs, one of the greatest (and most underestimated) risks to your hard-earned money.

Not sure what you’ll need? Chances are you’ll employ at least one of these legal tools before you die. Therefore, the more pertinent question may not be which you’ll use, but rather, whether you have a broader plan for protecting what matters most in your golden years. While there’s no cheat sheet for finding the right solution for your family, hopefully this guide, plus a caring estate planning or elder care attorney, will make it easier.