August 19, 2021 | Estate Planning

Do You Know What Your Estate Plan Is Missing?

And Better Yet, It Ought To Come Free

Do you know what your estate plan is missing? We’ll give you a hint…

Think about the people who provide some of the most critical services in your life—like an excellent physician, a reliable dog sitter, or even a beloved hairstylist. What do these all have in common? They don’t serve you transactionally. They’ve formed relationships with you. They’ve earned your trust by giving you the support you need.

So why is it that when it comes to one of the most critical services of all—estate planning—your estate attorney interacts with you transactionally? They create a plan and bill you for the work. Then, most of the time, you never hear from them again. It really doesn’t make sense, does it?

Now back to our question above. If you haven’t already guessed, the answer is support. As in lifetime support. Your cardiologist doesn’t perform your heart surgery without any follow-up. Likewise, your attorney shouldn’t create your estate plan without any follow-up either. Here’s why that’s important:

Because life changes

And when it does, your estate plan might need to as well. You need someone who’s familiar with your circumstances, as they’ve changed over time, and won’t miss a beat.

Because you’ll have questions

And when you do, you shouldn’t have to worry about whether you should ask because the simple act of picking up the phone might trigger a bill.

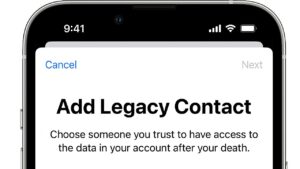

Because you don’t know what you don’t know

And it helps to have someone check in with you and flag anything you might not have known about that could necessitate an update to your estate plan.

Because the unexpected happens

And when it does, you want a familiar voice on the other end of the phone, not someone who asks, “Who is this again?”

The cost of not having lifetime support isn’t just emotional; it can also add up financially. Consider an outdated estate plan. It may contain critical omissions or provisions that are no longer applicable. Dealing with the effects of this could cost significant legal feels or time in probate court. Or, in the example of long-term care, if the estate plan hasn’t been updated to plan for the cost, you could risk losing your home or savings to nursing home fees. All of these instances are entirely preventable.

Providing lifetime support may not be par for the course at most law firms, but it’s something that’s important to us at AlerStallings. Every estate plan we create for our clients includes annual reviews and questions answered year-round for the rest of your life. We do this because good estate planning should never be transactional. You deserve to have someone who’s with you every step of the way.